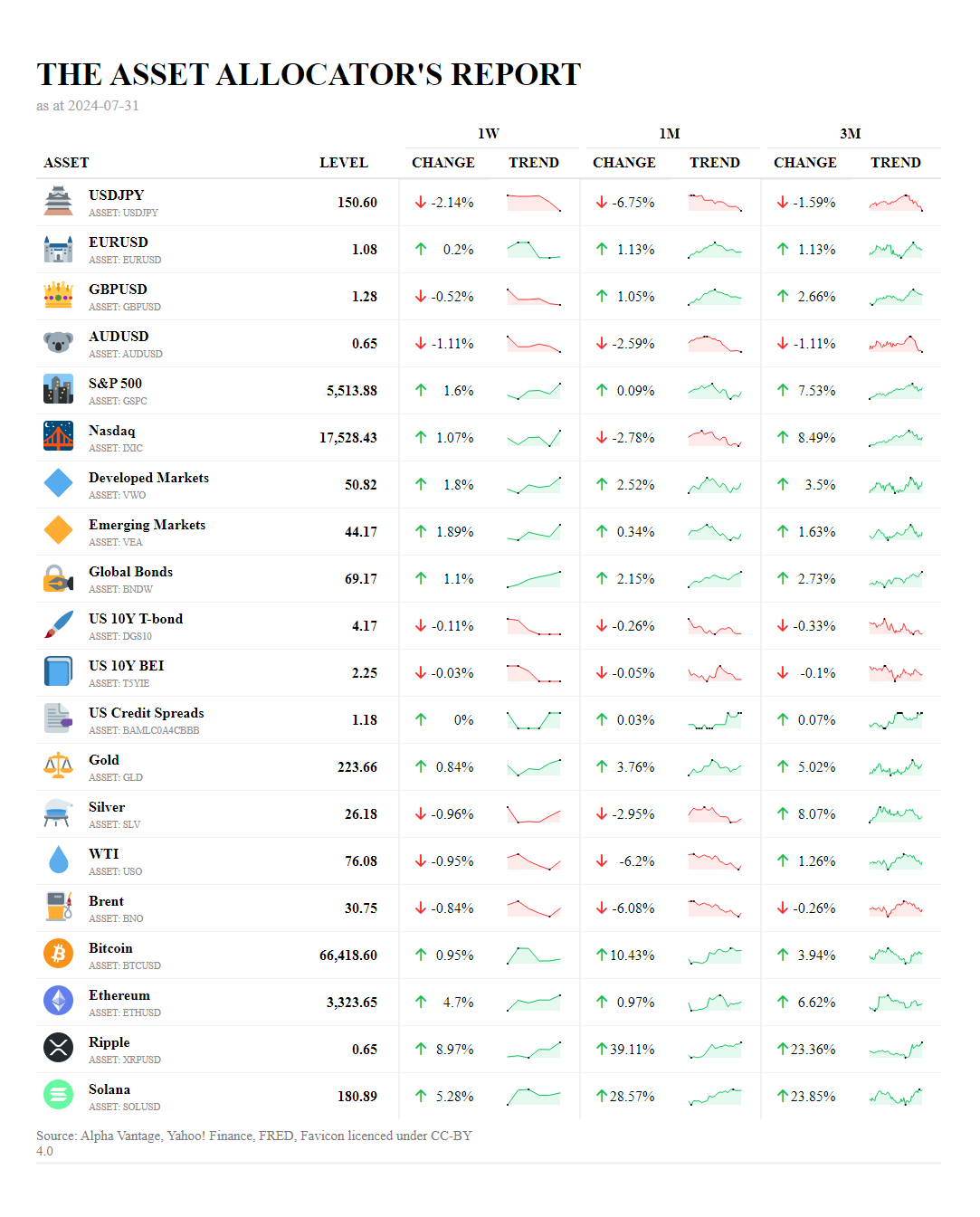

The S&P 500 and Nasdaq have shown robust performance over the past week, with gains of 1.6% and 1.07% respectively. This positive trend is underpinned by the US economy's unexpected growth of 2.8% in Q2, surpassing the forecast of 2.0%. This growth has bolstered investor confidence, despite the mixed performance in tech stocks. The anticipation of a potential rate cut by the Federal Reserve in September has further fueled optimism, particularly for debt-heavy small-cap stocks, which are expected to surge by 15% in August according to Fundstrat's Tom Lee.

Currencies: The USDJPY experienced a notable decline of 2.14% over the past week, reflecting the broader market's reaction to the US Federal Reserve's potential rate cuts and the Bank of Japan's monetary policy stance. Conversely, the EURUSD saw a modest increase of 0.2%, supported by the steadying of mortgage rates around 6.5% and the overall slowing inflation in the Eurozone.

Commodities: Gold prices edged up by 0.84%, driven by investors seeking safe-haven assets amidst economic uncertainties and the devaluation of money, as highlighted by "Big Short" investors' bullish stance on gold. Silver, however, declined by 0.96%, reflecting the mixed sentiment in the precious metals market. Oil prices, both WTI and Brent, saw slight declines of 0.95% and 0.84% respectively, influenced by geopolitical tensions and the ongoing economic challenges in Russia, where the central bank hiked interest rates from 16% to 18% to cool its overheated economy.

Cryptocurrencies: Cryptocurrencies have shown significant gains, with Ethereum up by 4.7%, Ripple surging by 8.97%, and Solana leading with a 5.28% increase. This surge is partly due to the broader market's anticipation of a more flexible monetary policy and the increasing adoption of blockchain technologies.

Bonds and Credit Spreads: Global bonds have performed well, with a 1.1% increase over the past week, reflecting the market's response to the steadying of interest rates and the positive economic data from the US. US 10Y T-bond yields slightly decreased by 0.11%, indicating a cautious optimism among investors regarding future rate cuts.

Emerging and Developed Markets: Emerging markets have shown resilience with a 1.89% increase, supported by the global economic recovery and the potential for rate cuts in developed economies. Developed markets also posted a 1.07% gain, reflecting the overall positive sentiment in the global equity markets.

The performance of equities, particularly in the US, has been strong, supported by robust economic growth and investor confidence. Commodities and cryptocurrencies have shown mixed results, reflecting the ongoing uncertainties and the search for safe-haven assets. Overall, the market is navigating through a complex interplay of economic indicators and geopolitical developments, with a focus on the potential impacts of monetary policy decisions in the coming months.

‘The desire to perform all the time is usually a barrier to performing over time’-Robert Olstein