All the King's Horses

Equity Report 10

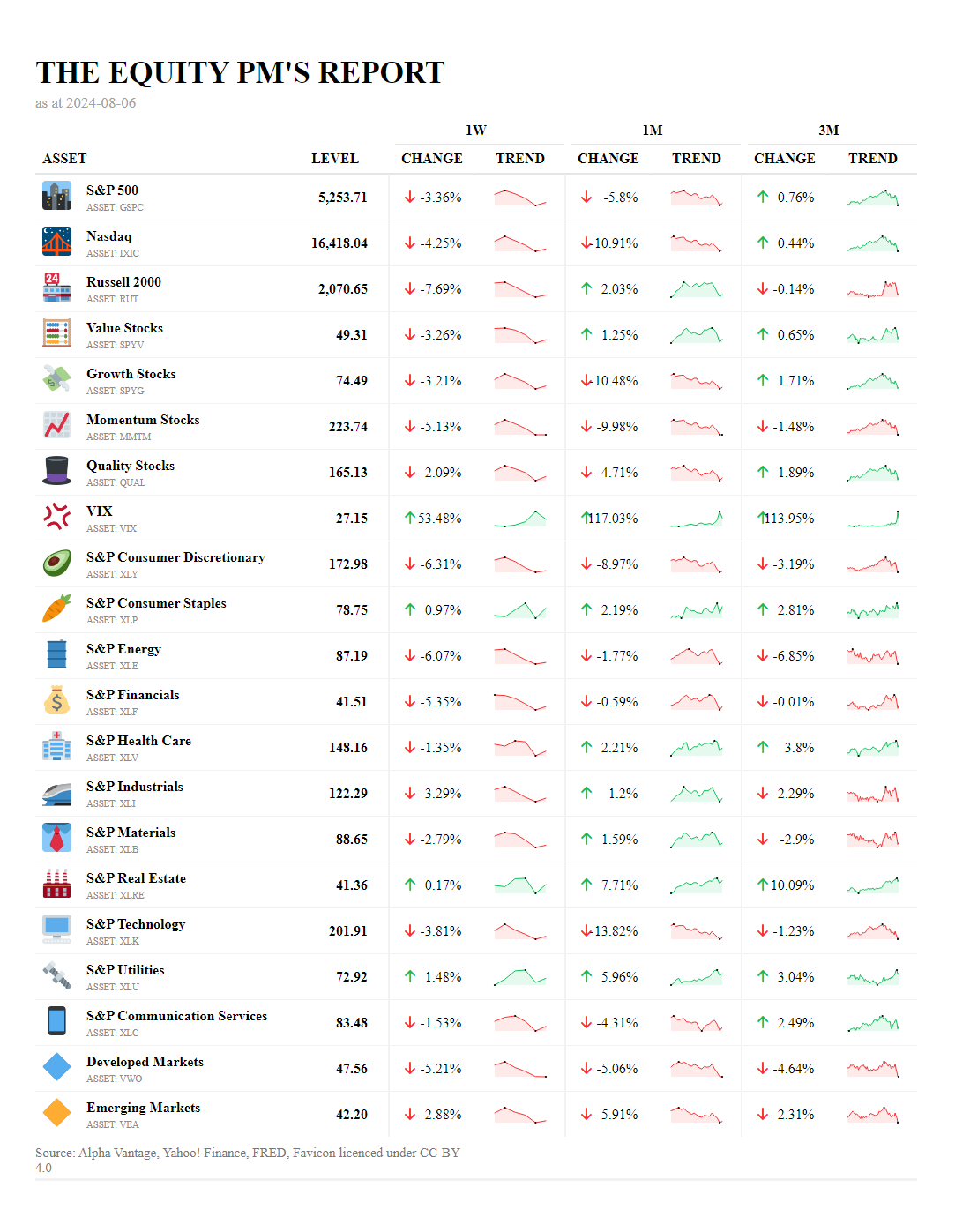

The past week reveal significant market volatility influenced by a confluence of economic indicators and geopolitical events. The S&P 500, Nasdaq, and Russell 2000 indices experienced notable declines of 3.36%, 4.25%, and 7.69% respectively over the past week, reflecting heightened investor anxiety.

Interest Rate Dynamics and Market Reactions: The Federal Reserve's potential rate cuts, driven by rising unemployment and weaker-than-expected job growth, have led to a drop in mortgage rates. This has provided some relief to the housing market but has not been sufficient to counteract broader market fears. The VIX, a measure of market volatility, surged by 53.48%, indicating increased market uncertainty.

Sector-Specific Performance:

Technology and Communication Services: The Nasdaq's 4.25% decline is partly due to significant sell-offs in major tech stocks, exacerbated by Berkshire Hathaway's substantial reduction in its Apple holdings. This move has intensified pressure on tech giants, with the S&P Technology sector down 3.81%.

Consumer Discretionary: The S&P Consumer Discretionary sector fell by 6.31%, reflecting concerns over consumer spending amid economic uncertainty. Reports of Americans cutting back on spending have further dampened investor sentiment in this sector.

Energy: The S&P Energy sector dropped by 6.07%, influenced by global economic slowdown fears and fluctuating oil prices. The sector's performance is also impacted by geopolitical tensions and shifts in energy policies.

Financials: The S&P Financials sector saw a 5.35% decline, as rising fears of a recession and potential rate cuts weigh heavily on financial institutions' profitability.

Healthcare and Utilities: In contrast, the S&P Healthcare and S&P Utilities sectors showed relative resilience, with minor declines of 1.35% and a gain of 1.48% respectively. These sectors are traditionally seen as defensive plays during economic downturns.

Global Market Influences:

Developed and Emerging Markets: Both developed and emerging markets experienced declines of 5.21% and 2.88% respectively. Japan's decision to raise interest rates and the subsequent sell-off in Asian markets have contributed to these declines. The global stock market rout, driven by recession fears and geopolitical tensions, has further exacerbated the situation.

The current market environment is characterized by significant volatility and investor caution. The interplay between economic data, such as rising unemployment and weak job growth, and geopolitical events, including Japan's rate hike and global recession fears, continues to drive market movements. Investors are closely monitoring the Federal Reserve's actions and their potential impact on market stability

.

"The market is a pendulum that forever swings between unsustainable optimism (which makes stocks too expensive) and unjustified pessimism (which makes them too cheap)." - Benjamin Graham