Caution

Multi Asset Report 6

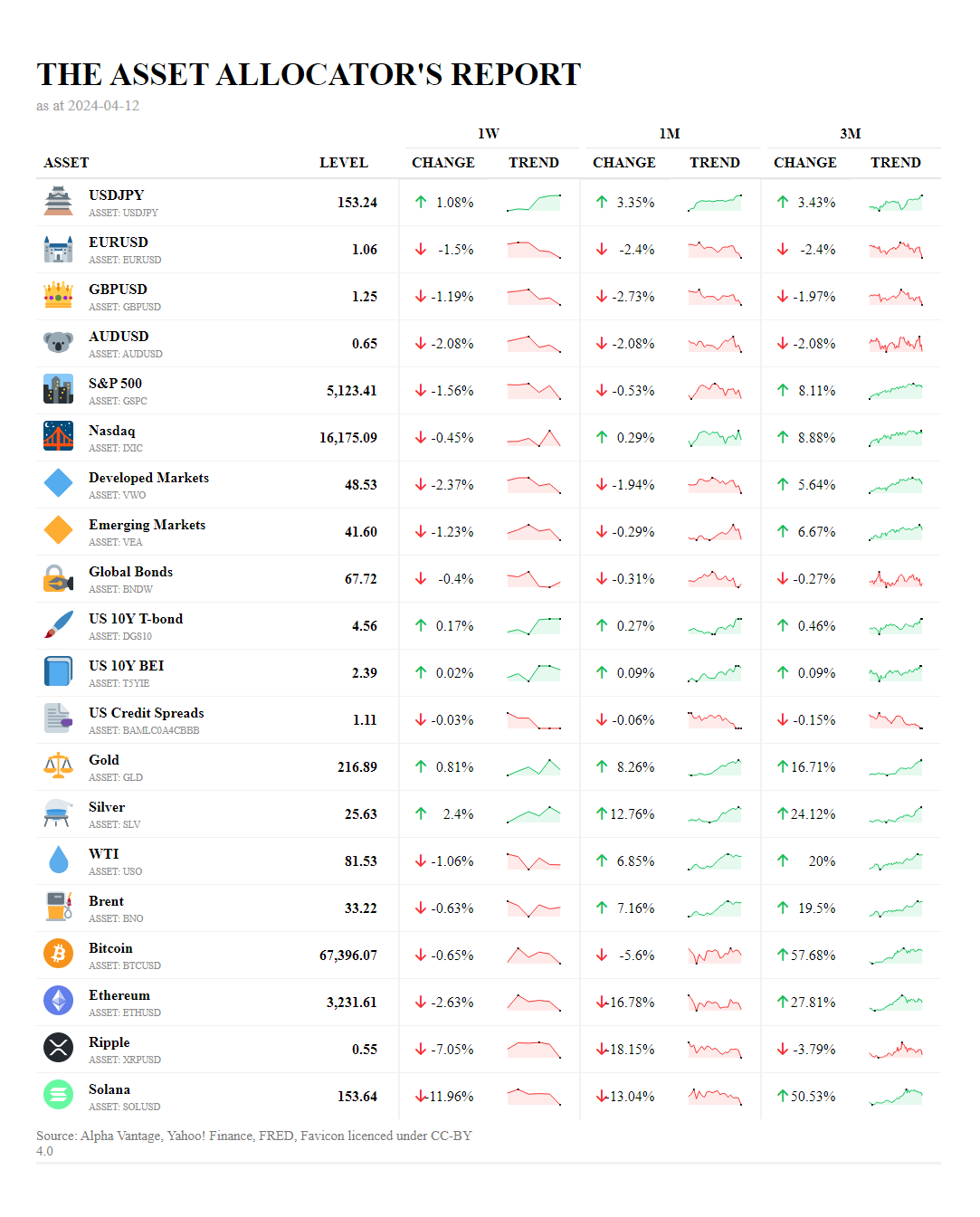

The last week presented a mixed picture of the global financial markets, reflecting a period of volatility and sector-specific trends. The Japanese Yen has strengthened against the US Dollar, with the USD/JPY pair rising by 1.08% over the past week and showing a robust upward trend over the last month and quarter. This could be indicative of a risk-off sentiment where investors are seeking shelter in traditionally safer assets.

In the forex space, the Euro and the British Pound have both depreciated against the US Dollar over the past week, month, and quarter, with the EUR/USD down by 1.5% in the past week and the GBP/USD down by 1.19%. The Australian Dollar also weakened, suggesting a broader strength in the US Dollar which may be attributed to the hawkish stance on interest rates and persistent inflationary pressures.

Equity markets have shown a downturn over the past week, with the S&P 500 and Nasdaq declining by 1.56% and 0.45% respectively. However, the three-month trend remains positive, indicating that the recent pullback could be a temporary correction in an otherwise bullish market. This aligns with the narrative of a strong economy that may delay anticipated interest rate cuts.

Developed Markets have underperformed, with a 2.37% decrease over the past week, while Emerging Markets have shown relative resilience, albeit also in negative territory with a 1.23% decline. This could be a reflection of the geopolitical tensions and trade uncertainties, particularly with the escalating trade war rhetoric between the US and China.

In the bond market, the US 10Y T-bond yield has seen a slight increase, suggesting a cautious approach by fixed-income investors amidst the interest rate environment. The minimal movement in US 10Y BEI indicates that inflation expectations are stable for the time being.

Gold and Silver have seen an uptick, with Gold rising by 0.81% over the past week, which may be investors hedging against inflation and geopolitical risks. Oil prices have softened, with WTI and Brent crude experiencing declines, potentially due to concerns over global economic growth and the impact of China's economic strategies.

Cryptocurrencies have faced significant headwinds, with Bitcoin and Ethereum both declining over the past week, month, and quarter. Ripple and Solana have seen even steeper declines, suggesting a broader risk-off sentiment in the digital asset space.

Overall, the investment landscape is navigating through a complex interplay of inflationary concerns, interest rate expectations, and geopolitical tensions.

“An investment in knowledge pays the best interest” -Benjamin Franklin

Upgrade to premium to get access to the high resolution pdf report download link below and exclusive insights and research