Dive

Multi Asset Report 10

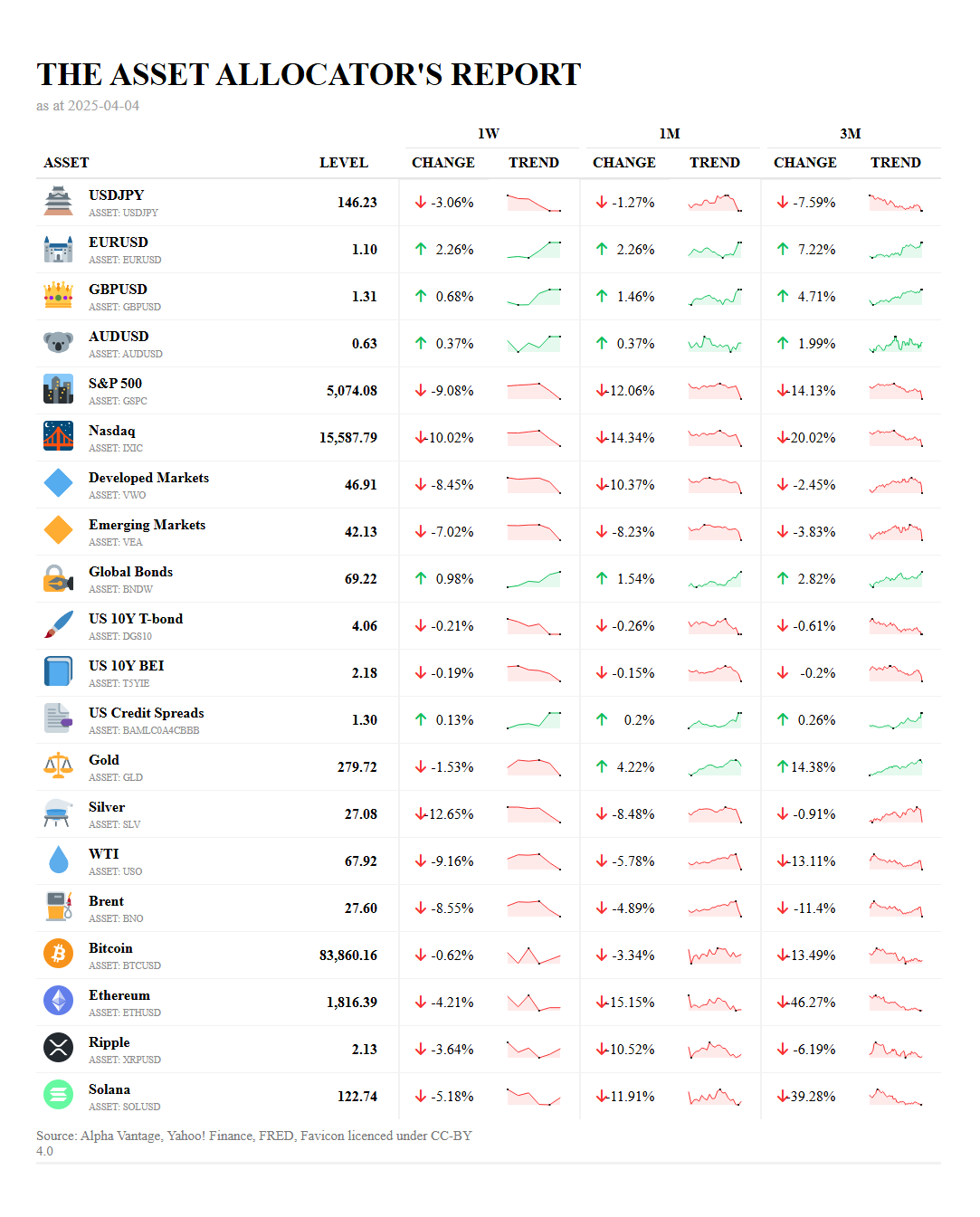

Equity markets suffered their worst decline since 2020 following Trump's "Liberation Day" tariffs, with the S&P 500 down 9.08% weekly and the Nasdaq falling 10.02%.

Recession probability has jumped to 60% according to JP Morgan analysts, triggering a shift in interest rate expectations toward earlier Fed cuts.

Gold has emerged as a top-performing asset, gaining 14.38% quarterly, while both oil and cryptocurrencies have experienced significant declines.

China has announced retaliatory 34% tariffs on US imports starting April 10th, escalating trade tensions and threatening global supply chains.

Economists estimate American households could face approximately $4,000 in additional annual costs due to tariff-related price increases, raising stagflation concerns.

The financial markets experienced their most turbulent period since 2020 last week, with equities suffering a dramatic selloff following President Trump's April 3rd announcement of sweeping new tariffs on multiple trading partners, an event the administration called "Liberation Day." The S&P 500 plunged 9.08% for the week and has declined 12.06% over the past month, while the technology-heavy Nasdaq experienced even steeper losses of 10.02% weekly and 14.34% monthly. This pronounced market reaction reflects growing investor anxiety about the potential economic consequences of escalating global trade tensions.

In stark contrast to the equity market decline, major currency pairs have strengthened against the dollar, with the EUR/USD up 2.26%, GBP/USD gaining 0.68%, and AUD/USD rising 0.37%. This currency movement suggests diminished confidence in US economic prospects under the new tariff regime. The fixed income market has demonstrated resilience amid the turmoil, with global bonds rising 0.98% for the week as investors seek safe havens. US credit spreads widened marginally by 0.13%, indicating some increased risk perception, while Treasury yields declined slightly, with the 10-year yield falling 0.21%.

Gold has emerged as a standout performer in the commodities space, declining 1.53% for the week but posting impressive gains of 4.22% monthly and 14.38% quarterly as investors flock to traditional safe havens. Goldman Sachs expects gold to reach $3,300 per ounce by year-end. Meanwhile, oil prices have plummeted, with WTI crude dropping 9.16% weekly and 13.11% quarterly after OPEC+ announced production increases amid concerns about global growth. The cryptocurrency market has not been spared from the broader market pressure, with Bitcoin down 0.62% weekly and 13.49% quarterly, while Ethereum and other altcoins have seen even steeper declines, with Solana suffering a 39.28% quarterly drop.

The probability of an economic recession has increased substantially following the tariff announcements. Market betting platforms now show recession odds at 54%, while JP Morgan analysts have raised their recession probability to 60%, warning ominously that "there will be blood." Goldman Sachs has cut its S&P 500 target and now sees a 35% chance of recession in the next 12 months. These elevated recession concerns have dramatically shifted interest rate expectations, with markets now anticipating that the Federal Reserve may need to implement rate cuts sooner than previously expected to counter economic weakness. While the March jobs report showed a surprisingly strong addition of 228,000 new positions, the unexpected jump in unemployment suggests potential vulnerabilities in the labor market. The decline in bond yields reflects this shifting monetary policy outlook.

The tariff situation presents a particularly complex backdrop for inflation. While economic slowdown typically reduces inflationary pressures, tariffs directly increase consumer costs. Economists estimate American households could face approximately $4,000 in additional annual expenses due to tariff-related price increases. If the average tariff rate exceeds 20%, as some analysts suggest, the economy could face stagflationary conditions—a challenging combination of high inflation and low growth that would further complicate the Federal Reserve's policy decisions. Several market commentators have drawn parallels to the 1930 Smoot-Hawley Tariff Act, which historians widely believe exacerbated the Great Depression.

The global response to Trump's tariffs has been swift and largely negative. China has announced retaliatory 34% tariffs on all US imports starting April 10th. European Union officials have described the measures as "extremely regrettable" and "totally unwarranted," with several countries preparing countermeasures. Notably, Cambodia, Laos, and Myanmar were hit particularly hard with tariffs of 49%, 48%, and 45% respectively, creating what some analysts describe as a golden opportunity for Beijing to strengthen its influence in Southeast Asia. This escalating cycle of trade restrictions threatens to further disrupt global supply chains, with major technology companies like Apple facing particular exposure due to their reliance on Chinese manufacturing.

Despite the significant market turmoil, some experts continue to recommend "Stay Home (versus Go Global)" investment strategies, arguing that US stocks remain relatively attractive compared to international alternatives despite current pressures. As noted by investment strategist Ed Yardeni, "We are maintaining our Stay Home bias, recommending that managers of global portfolios overweight US stocks." However, the situation remains highly fluid, with some previously bullish analysts now acknowledging the potential for a 2008-style market crash if US government debt continues to expand and economic conditions deteriorate.

The coming weeks will be critical as markets digest the full impact of these tariffs and assess whether President Trump might moderate his stance in response to market turbulence. Investors should prepare for continued volatility while maintaining discipline and long-term perspective. The proposed tariff caps on credit card interest rates by representatives like Alexandria Ocasio-Cortez highlight the broader political dynamic around economic fairness that may influence policy decisions. For now, portfolio diversification, quality focus, and careful monitoring of economic indicators remain prudent approaches in this increasingly complex investment landscape.

"Be fearful when others are greedy, and greedy when others are fearful." — Warren Buffett