Rebalancing Act

Spreads Report 1

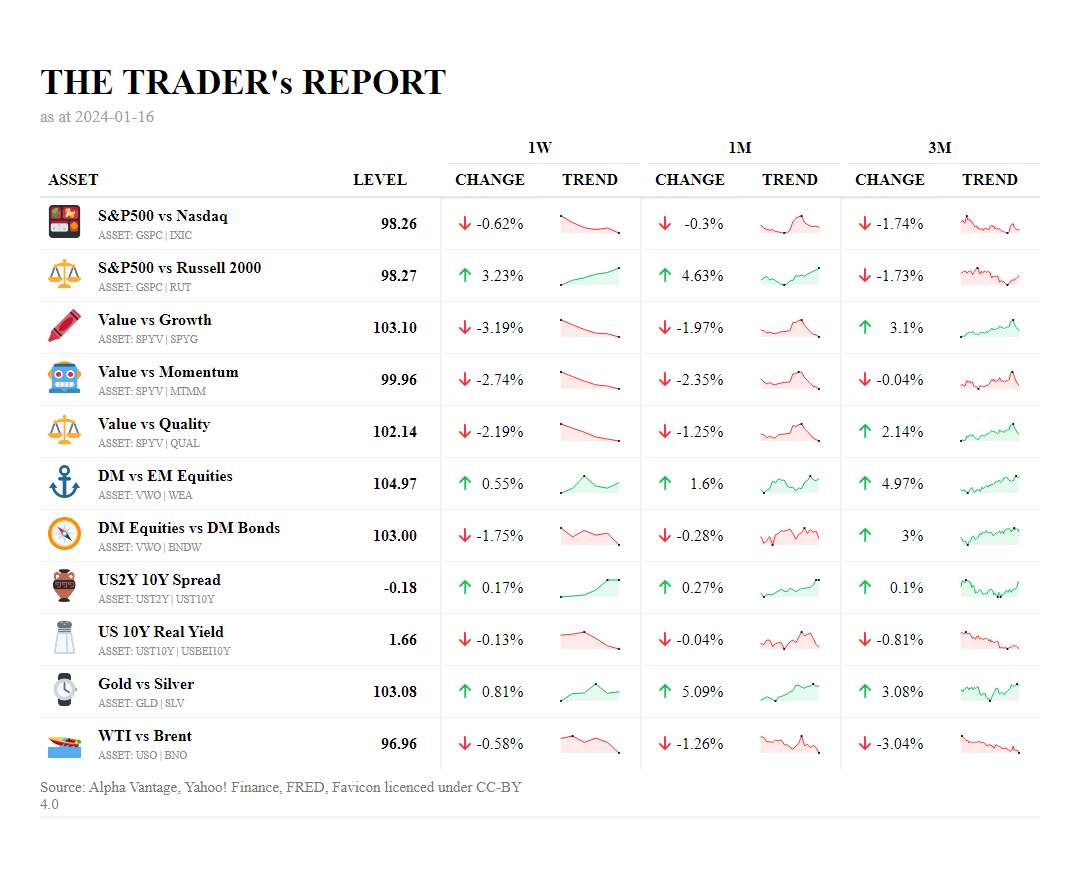

The week's data reflects a discerning investor shift toward large-cap stability, as the S&P 500 outperformed the Russell 2000 but tech remained dominant.

Growth stocks have taken the lead over value stocks, with a notable weekly spread decrease, which aligns with the broader medium-term trend of growth's dominance. Yet, the week also saw a dip in the spread between value and momentum, and value and quality stocks, revealing a nuanced rebalancing act among investors as they navigate between different equity styles.

Globally, the slight uptick in the spread between Developed and Emerging Market equities this week, and more substantially over three months, signifies a steady conviction in the stability and potential of developed markets.