Summit Cameo

Equities Report 4

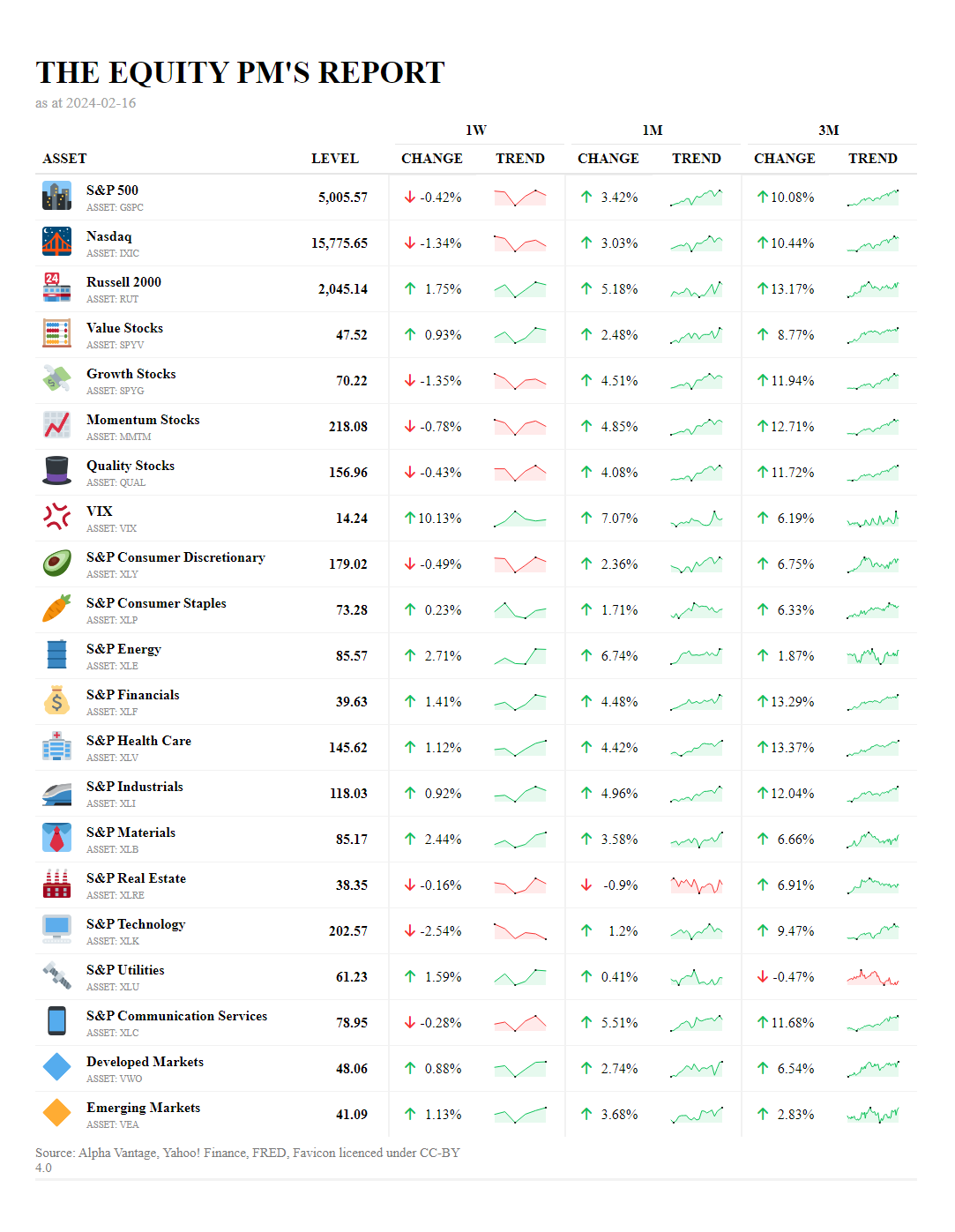

The S&P 500 and Nasdaq both topped recorded all time highs before an unfavorable US CPI print sent the markets sprawling the prospects of future rate cuts dwindled. While this sent the Mega caps reeling Small-cap stocks, as represented by the Russell 2000, have outperformed with a remarkable 1.75% increase over the week, continuing an impressive run despite economic headwinds.

Growth sectors and interest rate sensitive sectors suffered the most with Tech, Communications, Consumer Discretionary and Real Estate bearing the brunt of the fall from grace The VIX, a measure of market volatility, has spiked by 10.13% in the past week, suggesting increased market uncertainty in the short term.

True to form Value stocks posted a good showing over of the week of 0.93% gain, beating out it’s Momentum, Growth and Values counterparts in a rare occasion.

Emerging Markets continued it’s recent outperformance vs developed markets despite geopolitical unease and economic uncertainty around China.

“There’s no shame in losing money on a stock. Everybody does it. What is shameful is to hold on to a stock, or worse, to buy more of it when the fundamentals are deteriorating.” - Peter Lynch

Upgrade to premium to get access to the high resolution pdf report download link below and exclusive insights and research