Pushing Forward

A Visual Analysis on Nasdaq R&D

In an era of rapid technological evolution and digital transformation, Research and Development (R&D) stands as a pivotal driver of competitive advantage and innovation, particularly with the advent of Generative Artificial Intelligence (AI). As companies in the Nasdaq navigate this new terrain, the role and impact of their R&D expenditure come into sharp focus. Let's delve into how these companies are faring in harnessing R&D to thrive in this new age.

TLDR:

Sector analysis shows a clear pattern of R&D investment, with IT and Health Care leading in R&D intensity. This reflects the rapid evolution and competitive dynamics within these sectors.

The largest firms by market cap are major R&D spenders in absolute terms but show varied R&D intensity.

There is a positive correlation between R&D intensity and market performance, but the relationship is not linear, suggesting the impact of R&D on performance is nuanced and influenced by multiple factors.

Fig 1.

There is a positive relationship between R&D intensity and investment performance, with a noticeable upward trend. However, the variability of observations suggests that while a general positive trend exists, other factors also significantly influence investment performance.

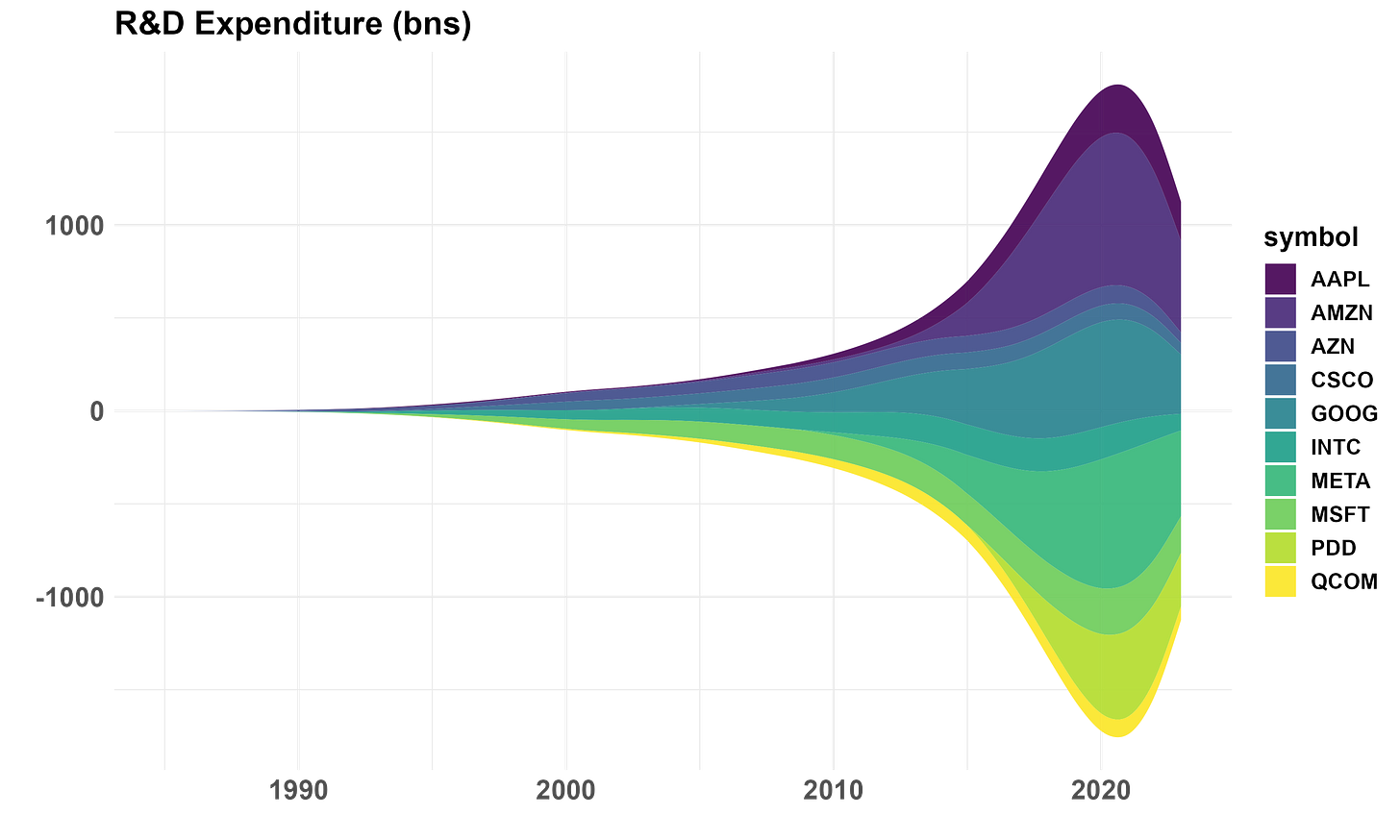

Fig 2.

Larger companies do not necessarily have higher R&D ratios, suggesting differing economies of scale in R&D spending. High R&D intensity also does not uniformly translate to high returns, suggesting that the efficiency of R&D spending and the ability to convert it into profitable growth varies.

Fig 3.

Firms like TEAM, DDOG, and WDAY lead, indicating a strategic focus on R&D to fuel their business models and future growth.

Fig 4.

Technology giants like AMZN, GOOG, META, AAPL, and MSFT still lead the pack in terms of absolute spend with AMZN well ahead.

Fig 5.

Information Technology (IT) and Health Care emerge as sectors with the highest R&D intensity, whereas sectors like Utilities and Real Estate invest less in R&D relative to revenue. This aligns closely with the product development lifecycles inherent in these companies and is reflective of opportunity set

Fig 6.

R&D expenditure has expanded materially amongst the top companies over the past three decades, with significant growth in expenditure after 2010. This suggests a heightened focus on innovation and development in recent years with a tapering off after 2020.

Let’s end on a poll

"Change is the investor's only certainty."-Thomas Rowe Price Jr.